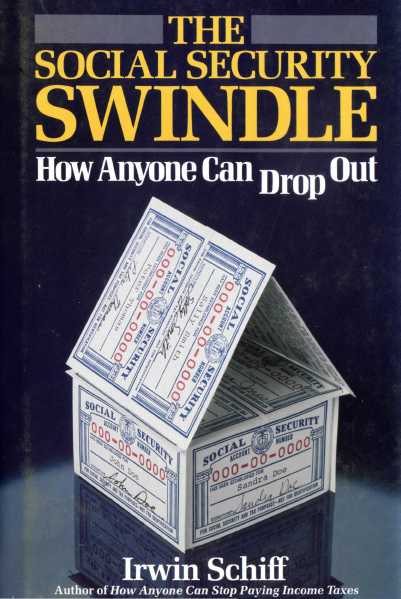

IRWIN SCHIFF BLOWS SOCIAL SECURITY

APART!

AND REVEALS IT TO BE

A LEGAL, ECONOMIC, MORAL

AND SOCIAL FRAUD.

This book will save you thousands of dollars

and

• Explain why there is no such thing as a "Social Security" tax.

• Provide you with all the legal statutes that establish why you are not required to pay such a "tax'.'

• Explain the specific procedures necessary to drop out.

• Provide the legal and historical documentation explaining how the government foisted this "bogus tax" on the American people.

Discover why Social Security must qualify as the greatest swindle of them all!

Freedom Books • 60 Connolly Parkway • Hamden, CT 06514

$12.95

Irwin Schiff, author of the nationwide bestseller How Anyone Can Stop Paying Income Taxes, has done it again! His explosive expose'of Social Security—the biggest chain letter of them all — reveals in vivid detail all the underhanded practices employed by the Federal Government to foist this swindle on the American public. No less shocking is the outrageous ploy used by the Supreme Court to get this admittedly unconstitutional law on the books. His incredible insight into the workings of the Supreme Court is, alone, worth the price of the book.

THE SOCIAL SECURITY SWINDLE — HOW ANYONE CAN DROP OUT, is written in Schiffs now famous clear and breezy style and is not based solely on the author's opinion, but it is amply documented by over 50 excerpts from the law itself, numerous official exhibits and a thorough analysis of relevant court cases. What emerges is a powerful indictment of the Supreme Court and irrefutable proof that Social Security is a legal, economic, social and moral fraud.

Not satisfied with merely presenting the facts, Schiff also provides readers with all the necessary documents and step-by-step procedures so that all (employees, employers and self-employeds) can drop out of the Social Security scam.

Though an analysis of law, court cases and government documents would normally provide dull and uninteresting reading, Schiff s presentation leaves the reader reeling as he moves from one shocking revelation to another. It is hard to believe that 96 million Americans have pinned their financial future to a false hope, but the evidence is all here and cannot be refuted. For those unwilling to be led like sheep to the financial slaughter, Schiff offers a concrete alternative — DROP OUT NOW!

Freedom Law School

9582 Buttcmcrc Road Phelan, CA 92371

(760) 868-4271

www.livcfrecnow.org

frccdom@livefreenow.org

Return to: Freedom Books P.O. Box 5303 Hamden, CT 06518

Irwin A. Schiff, untax expert, lecturer and America's most visible constitutionalist, is the author of several other non-fiction works about taxes and government waste. They include The Biggest Con: How The Government is Fleecing You, a book that deals with the destructive nature of the Federal government; The Kingdom ofMoltz, a comic satire on money and inflation; and How Anyone Can Stop Paying Income Taxes, the nation's best selling hard cover book on taxes and the definitive work on how the IRS extorts billions of dollars from unsuspecting Americans every year. He also writes and publishes The Schiff Report, a popular and influential publication, describing specific techniques to fight the IRS's illegal procedures.

He has appeared on such national television programs as CBS' "NIGHTWATCH", "THE DAVID SUSSKIND SHOW", "THE FINANCIAL NEWS NETWORK", "RUFF HOUSE", "CABLE NEWS", "TOM SNYDER", and guested TV shows in nearly every major U.S. city including San Francisco, Chicago, New York, Los Angeles, Seattle, Portland, Miami and Dallas. He has also been the repeat guest of many popular radio talk show hosts such as Ray Briem, Michael Jackson, Bob Grant, Joel Spivak, Ed Hartley, Patrick J. Timpone, Pat Whitley, John Signa, Joe Lombardo, Joel Rose and Sid Barlow.

Schiff, a resident of Hamden, Connecticut has two sons, Peter and Andy.

We hope you found the information in this book helpful. If you would like additional information on other areas of taxation, where citizens are being equally misled, you are invited to return the enclosed coupon. We will then be able to send you information on "The Schiff Report" and notify you of upcoming books, reports, and studies dealing with taxes at all levels of government.

Name_Address_City_State_Zip_

The

Social Security Swindle — How

Anyone Can Drop Out

by IRWIN SCHIFF

jfreebom poote

Hamden, Connecticut

This book is designed to provide the author's findings and opinions based on research and analysis of the subject matter covered. This information is not provided for purposes of rendering legal or other professional services, which can only be provided by knowledgeable professionals on a fee basis.

Further, there is always an element of risk in standing up for one's lawful rights in the face of an oppressive taxing authority backed by a biased judiciary.

Therefore, the author and publisher disclaim any responsibility for any liability or loss incurred as a consequence of the use and application, either directly or indirectly, of any advice or information presented herein.

Sections of the Internal Revenue Code reprinted by permission from the Tax and Professional Services Division, The Research Institute of America, Inc. Copyright ® 1983.

Copyright® 1984 by Irwin A. Schiff

All rights reserved. Printed in the United States of America. No part of this book may be used or reproduced in any manner whatsoever without the prior written permission of the publisher.

Library of Congress Catalog Card No. 83 -90489

ISBN-0-930374-05-3

84 85 86 87 10 9 8 7 6 5 4 3 2 1

TO

Former Supreme Court Justices Pierce Butler and James C. McReynolds and former United States Circuit Judges James M. Morton, Jr. and Scott Wilson. By declaring Social Security unconstitutional in 1937, they demonstrated that they were members of a vanishing breed — Federal judges who understand and enforce the United States Constitution.

Books By Irwin A. Schiff

How Anyone Can Stop Paying Income Taxes

The Kingdom of Moltz

The Biggest Con: How The Government is Fleecing You

Contents

INTRODUCTION ....................................... H

1. Socialism Arrives in America ............................. 15

2. Surprise! Social Security — Just Another "Income

Tax" .................................................. 23

3. How To Stop Employers From Withholding "Social

Security" Taxes........................................ 39

4. Employers and Self—Employeds— How They, Too,

Can Drop Out ......................................... 47

5. The Supreme Court — Playing Games With The Law....... 65

6. How Social Security Was Sold To The Public — Would

They Buy It Today? .................................... 99

7. An Analysis of Government Studies: Proof That

Government Cannot Be Trusted.........................109

8. Of Taxes And Trust Funds................................163

9. The System Encourages Rampant Abuse...................173

10. Why Dropping Out Of Social Security Is In The

National Interest ......................................191

Appendix A: Chapter 4 — The Biggest Con-How The Government Is Fleecing You ............................209

Appendix B: Pages 302-304, The Biggest Con...............233

Appendix C: Sample Lawsuit .............................239

Appendix D: Private Sector "Experts" .....................243

Legal Cases Cited........................................251

Reading List.............................................253

Introduction

In October, 1934, after serving approximately 10 years in jail, a little Italian immigrant named Charles Ponzi was deported to Italy after pulling off one of the greatest swindles America had ever witnessed.

In December, 1919, Ponzi convinced about a dozen people that he could make them a 50% profit in 45 days by trading in international postal coupons.

At the end of the first 45 days his first batch of "investors" lined up to claim their profits. Sure enough, Ponzi was as good as his word and paid his investors $375.00 for the $250.00 initially given him. As Ponzi expected, most of his investors handed the money right back to him so he could reinvest it for them and then they fanned out into the community, spreading the news that Ponzi could make everyone rich.

The news spread quickly. Within a month thousands of people, money in hand, lined up in front of Ponzi's School Street office. He even hired 3 women to serve franks and coffee to those who had to wait. By

April of 1920 he was taking in $250,000 a day, had 16 clerks just taking in money and nearly as many guarding it.

In less than 6 months Ponzi collected over $10 million and his name was known from coast to coast. He refurbished his office and gave his company the impressive title, "SECURITIES EXCHANGE COMPANY". He purchased a 20 acre estate near Boston and spent $500,000 redecorating it. He supposedly spent $100,000 just stocking the wine cellar! He purchased large tracts of land and large interests in banks and investment companies.

A chauffeur and footman, outfitted in plum colored livery, squired him around the city in a custom built limousine. Everywhere he went he was beseiged by well-wishers who cheered him and implored him to take their money.

Ponzi's scheme collapsed when a spiteful former friend notified Boston police that Ponzi had served 3 years in a Montreal jail for forgery. This was confirmed by the Montreal police on April 11, 1920 when they supplied Boston authorities with a mug shot of Ponzi.

What Ponzi had done, of course, was simple...he used the money given him by new "investors" to pay off older "investors". As long as more money came in than had to be paid out, the scheme worked (in all such scams money will keep coming in as long as enough people believe that they, too, will make what others are reported to have made). He was even able to skim off considerable amounts for himself to create and maintain a lavish personal and business life-style.

What promoters of such swindles hope to do, of course, is to vanish with enough loot before the last round of victims realize they have been taken. Early "winners" are necessary in order for the scam to work.

Such swindles, however, depend on an ever expanding army of new participants relative to those who drop out. When the tide turns, the scam inevitably collapses. The losses sustained by all those left holding the bag at the end finance the gains realized by earlier participants and the "profit" that the promoters skimmed off.

Chain letters and pyramid schemes are variations of the Ponzi scam and rely, more or less, on the same principle. Americans have now been victimized by the greatest Ponzi swindle of them all - SOCIAL SECURITY! It really isn't any different from the scheme devised by Ponzi some 60 years ago - it's only bigger. It would not be inappropriate for the Social Security Administration to commission a large statue of Ponzi to adorn its main lobby in Baltimore, Maryland!

The only difference between Social Security and Ponzi's scheme is that Social Security is much larger (involving a whole country) and was implemented by force. At least Ponzi didn't put a gun to anyone's head and force them to give him their money. And, like all Ponzi-type schemes, Social Security did allow some winners in the beginning; but, in the end, it, too, must collapse, leaving disappointment and heartache in its wake. Three or four generations of Americans will simply lose what two or three other generations might have gained and what was skimmed off by the plan's promoters — the Washington Bureaucracy.

The political con artisits who pulled off and participated in this swindle must be punished. It is to this end that this book is also dedicated.

1

Socialism Arrives in America

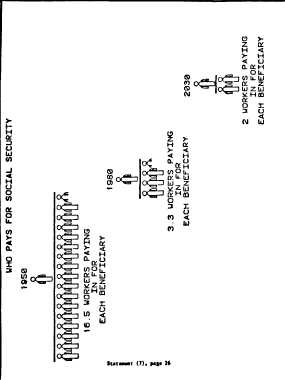

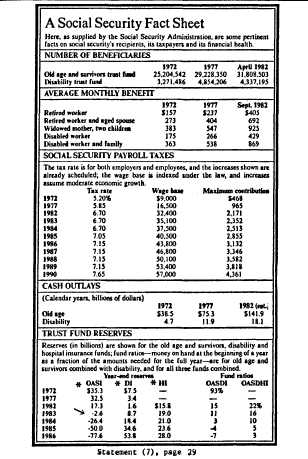

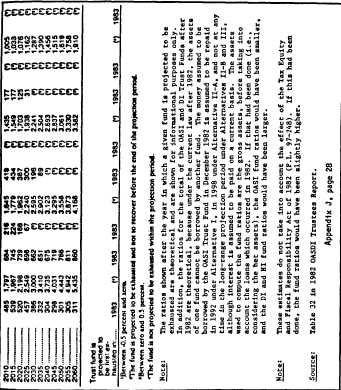

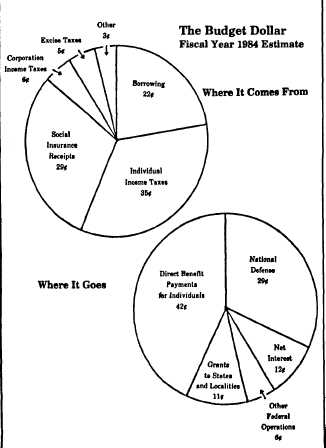

Social Security, a program that sprang from the womb of socialism is nothing more than a grotesque economic and social abortion. Like Socialism itself, it owes its very existence to public ignorance and gullibility. Both are swindles on every level — economic, social, moral and legal. The government has consistently misrepresented every aspect of Social Security to the public so Americans have absolutely no conception of an item in the Federal budget that accounts for 30% of the government's expenditures. The implication of this is staggering: better than 99% of Americans do not know anything about a program that consumes as much in taxes as does defense spending!

Social Security is an economic fraud. It is not supported by even one sound economic principle; but, rather, is rooted in the pie-in-the-sky concepts of socialism and the chain letter. As such, it has constantly lowered the nation's standard of living.

It is a fraud on the social level since it actually breeds, aggravates and intensifies all of society's social problems (i.e. creating a less self-reliant population, promoting crime, juvenile delinquency, dependency and unemployment). In effect, Social Security creates and breeds social insecurity, the exact opposite of its

grandiose, presumptuous, self-serving and misleading title. In addition, the government has totally misrepresented its legal and financial character. What the public has been fed is a complete fairy tale—totally at odds with the real financial and legal nature of the program. However, when we face the fraudulent and illegal character of Social Security, we are brought face to face with what must be the fraudulent character of the Federal judiciary. Without the help of a fraudulent judiciary, the government could never have foisted such an illegal program on the public.

Social Security's early advocates and promoters merely adopted the simplistic (but politically salable) economic nostrums of socialism, a common characteristic of much of what was passed off as "New Deal", "Fair Deal", "Great Society" and "New Frontier" programs. Variations of basic socialist doctrine were successfully peddled to the American public under the guise of "liberalism" and the "welfare state", a supposedly benevolent form of free enterprise. In reality, though, the "welfare state" is nothing but socialism disguised and peddled to the public under a more acceptable label.

Politicians generally, of course, love to believe the social and economic philosophies espoused by left-wing intellectuals,1 since such philosophy fits right in with campaign rhetoric. Politicians love to promise the public that they (the politicians) can wipe out poverty, raise

1 Actually a contradiction of terms since no real intellectual could possibly accept the absurd and unworkable theories of socialism. Those who embrace such theories are not really intellectuals; they are usually social and economic theoreticians (either being too lazy to work or lacking in the ability to create real goods) who, for obvious psychological reasons, reject the economic theory that rewards hard work, creativity and risk taking in favor of one that compensates non-producers and economic cowards (which they invariably are) out of all proportion to their economic and social worth.

living standards, lower rents and interest rates, reduce unemployment, save jobs, "make war on poverty", etc. They promise to do all of this without increasing taxes or requiring anyone to work harder or longer. Unfortunately, all too many are gullible enough to believe this — that politicians, who themselves produce nothing, can increase society's real wealth with laws and economic mirrors. Government all too often fills the need of those who must cling to a belief in Santa Glaus.

But our nation's sorry crop of politicians don't raise society's standard of living—they lower it. All they do is pass laws that confiscate the wealth of some (in the guise of taxation) for the benefit of others, in exchange for votes. In the process, these politicians do earn considerable sums (and fringe benefits) for themselves ... which is why they go into politics in the first place.2

The majority of successful politicians are usually lawyers. Can you think of any segment of society less productive than lawyers?3 In the final analysis it can be said that government today largely consists of a bunch of lawyers passing largely unnecessary laws which (though interfering with society's real producers) do generate a lot of lucrative legal work and influence

1 It has also been my observation that the least productive members of society go into politics. Picture an individual who is hard working, creative, inventive with a lot of integrity. Ask yourself, "Does such a person go into politics?" Of course not! There might be some exceptions to this, but not many.

81 am not saying that society does not need some good lawyers, especially where criminal law and Constitutional rights are concerned. But it is my experience that most lawyers are incompetent and overpriced, with a good deal of their work being largely unnecessary. In addition, 75% of the world's lawyers practice in America ... this, alone, proves my point. Incidentally, America has 20 times as many lawyers per capita as Japan, which alone explains Japan's increasing ability to out-produce the U.S. in the area of consumer products.

peddling for them and their cronies in the bar association.4

America's founding fathers, fully aware of the type of tyranny that governments are capable of, created a Constitution and a Bill of Rights to limit the power of government so as to prevent such tyrannies from taking place. Federal judges were appointed for life to keep them (theoretically) honest and independent so they would conscientiously enforce this Constitution and the rights secured under it to the public. The Federal judiciary, however, being a part of the Federal government itself, disregarded this trust and continually used its position to illegally expand the power and influence of the Federal government while under-mining individual rights and state sovereignty.6

Social Security

Must Lower the Nation's Standard of Living

It is a fundamental economic law that any society will get less of what it taxes and more of what it subsidizes. This principle is so basic that it qualifies as a truism. Let me explain how it works. If a government,

4 Since licensed lawyers are "officers of the court" all lawyers are automatically a part of the judicial branch of government. Thus, all licensed lawyers who serve in any legislature or executive capacity are automatically a part of two branches of government (legislative and judicial or executive and judicial) at the same time. Such a situation violates the "separation of powers" doctrine. Citizens in every state should seek to bar licensed lawyers from the other two branches of government unless they surrender their bar licenses. Otherwise, not only does such a situation violate the "separation of powers" doctrine, it violates the Constitutional provision outlawing the establishment of a "nobility". Ordinary Americans who are not lawyers are denied access to the judicial branch of government and can only serve in two branches of government while lawyers can serve in all three - and two of them at the same time! This constitutes a form of "nobility" that is barred by the Constitution.

for example, placed a tax of $100.00 per year on "playing tennis", fewer people would play tennis. To some, playing tennis would not be worth $100.00 per year. If the "tennis playing" tax were raised to $200.00 per year, society would get fewer tennis players still. If the tax on "tennis playing" was increased further we would obviously get even fewer tennis players. And, if the tax were raised high enough, we could conceivably wipe out tennis playing altogether!6 Social Security (which you will soon learn is simply another "income" tax) is a tax on productivity since only those who are productive (i.e. working) are taxed. So, if government taxes "productivity", society must (in conformity with economic law) get less of it.

The collateral principle, that a society "will get more of what it subsidizes", is also a truism. For example, if our government stated that it would pay an annual subsidy of $100.00 to anyone who played tennis, some people would now play tennis for the $100.00 subsidy. The nation would suddenly find it had more tennis players. If the government raised the "tennis" subsidy to $200.00 per year, we would obviously get more tennis players still. And, if the government raised the subsidy high enough, everybody in the country who could make it to a tennis court would be playing tennis!

Since all Social Security "benefits" are tied to "not working" or working less, Social Security payments amount to a government subsidy for "not working" and,

5 The 10th Amendment was specifically designed to protect and secure individual rights and state sovereignty. It states, "...those powers not delegated to the United States by the Constitution nor prohibited to it by the States, are reserved to the States respectively or to the people."

' Or, as was succinctly put by Chief Justice John Marshall, "The power to tax involves the power to destroy." (McCulloch v. Maryland, 4 Wheat. 316 (1819)

in turn, America gets a lot more "non-workers" because of it. Since Social Security amounts to a tax on "productivity" and a subsidy for "non-productivity", the existence of such a program delivers a two-fold blow to the nation's economy. The nation gets fewer producers and more non-producers, which has to lower the nation's standard of living and quality of life.

The government succeeded in selling such an idiotic plan to the nation because thousands of Federal politicians and bureaucrats have been thoroughly misstating and misrepresenting Social Security to the public.

It has also received a lot of help over the years from supposed "experts" who have been feeding the public a lot of nonsense concerning Social Security. Examples of such nonsense are included in Appendix D.

So let's cut through all the nonsense, find out what Social Security really is, and discover how anyone can drop out.

SUMMARIZING THE POINTS COVERED IN CHAPTER 1

1. Social Security is rooted in Socialist doctrine.

2. Social Security (being a tax on producers for the benefit of non-producers) must decrease the number of producers while increasing the number of non-producers.

3. The inevitable result of 2 above is a continual lowering of the nation's standard of living.

2

Surprise!

Social Security

Just Another

"Income" Tax

Reproduced in Figure 1 is the Internal Revenue Code section that establishes the present, basic 5.4% rate for "Social Security". Figure 2 is the Code section that presumably establishes the supplemental 1.3% rate for "medicaid", which equals the current 6.7% "Social Security" tax withheld from wages.

Note that Chapter 21 of the Code is specifically entitled Federal Insurance Contributions Act while sections 3101(a) and 3101(b) are respectively captioned "Old Age, Survivors and Disability Insurance" and "Hospital Insurance". Read over both Code sections and see what impression you get. After reading them, did you conclude that they deal with taxes for "hospital insurance" and/ or "old age and disability insurance"? Read them again and see if either section deals with any such programs!

First of all, chapter titles and section headings do not constitute apart of the law, but the public would not know this when reading the Code. Both the Chapter Title and Code captions used here are deliberately designed to fool the public as to what the law actually is.

FIGURE 1

CHAPTER 21.—FEDERAL INSURANCE

CONTRIBUTIONS ACT N

Subchapter

A. Tax on employees. Chapter Title

B. Tax on employers.

C. General provisions.

Subchapter A.—Tax on Employees

Sec.

3101. Rate of tax.

3102. Deduction of tax from wages.

Sec. 3101. Rate of tax. Section Heading

(a) Old-age, survivors, and disability insurance. *"~

In addition to other taxes, there is hereby imposed on the income of every individual a tax equal to the following percentages of the wages (as defined in section 3121(a)) received by him with respect to employment (as denned in section 3121(b))—

(1) with respect to wages received during the calendar years 1974 through 1977, the rate shall be 4.95 percent;

(2) with respect to wages received during the calendar year 1978, the rate shall be 5.05 percent;

(3) with respect to wages received during the calendar years 1979 and 1980, the rate shall be 5.08 percent;

(4) with respect to wages received during the calendar year 1981, the rate shall be 5.35 percent;

(5) with respect to wages received during the calendar years 1982 through 1984. the rate shall be 5.40 percent;

(6) with respect to wages received during the calendar years 1985 through 1989, the rate shall be 5.70 percent; and

(7) with respect to wages received after December 31, 1989, the rate shall be 6.20 percent.

FIGURE 2

Code Sec. 3101

Section Heading

Cb) Hospital insurance. ^

In addition to the tax imposed by the preceding subsection, there is hereby imposed on the income of

every individual a tax equal to the following percentages of the wages (as defined in section 3121(a)) received by him with respect to employment (as defined in section 3121(b))-

(1) with respect to wages received during the calendar years 1974 through 1977, the rate shall be 0.90 percent;

(2) with respect to wages received during the calendar year 1978, the rate shall be 1.00 percent;

(3) with respect to wages received during the calendar years 1979 and 1980, the rate shall be 1.05 percent;

(4) with respect to wages received during the calendar years 1981 through 1984. the rate shall be 1.30 percent;

(5) with respect to wages received during the calendar year 1985, the rate shall be 1.35 percent; and

(6) with respect to wages received after December 31, 1985, the rate shall be 1.45 percent.

For example, the Chapter title, "Federal Insurance Contributions Act", is, itself, a lie. As explained in Appendix A "Social Security" is not "insurance", and, in any case, it is supported by forced exactions - not voluntary "contributions".

The paragraph subheadings are also deliberately designed to carry out the misleading idea that somehow

the law deals with "contributions" for these "insurance" benefits, when this is not at all the case. You can prove this yourself by placing your finger over the caption headings and reading the law as written. You will discover that there is nothing in the law that even mentions old age, disability, survivors or hospital insurance benefits at all! So, if the law itself does not mention these subjects, how can the captions (which are not part of the law) refer to them?! Obviously the captions were designed to (mis)lead the public concerning what the law itself is all about. The fact is, if the law really contained the material suggested by those captions, "Social Security" would have been declared unconstitutional a long time ago!1

By reading the law (and forgetting the captions), you will quickly discover what has been going on — which is something entirely different from what the nation has been led to believe.

First of all, the public believes that "Social Security" is a tax on "wages". But as you can see from the law, "Social Security" is really nothing more than another "income" tax! American wage earners have been paying two "income" taxes — one collected on the basis of a form 1040 (subject to deductions and exemptions) and another (a flat rate "income" tax automatically deducted from wages) not subject to such deductions or exemptions! Can the Federal government make some Americans subject to two "income" taxes while excluding others (such as retirees and government employees) from the same tax?? Surely not!

It is important to note that the "income" tax established in Code section 3101 is merely "collected as a percentage of wages", but the tax itself is clearly identi-

1 See page 81.

fled as an "income" tax and not a tax on wages! It is possible to have wages but not income, since "income" (as used in the 16th Amendment) is a legal concept separate and distinct from wages!2 As a matter of fact, the word "wages" is not even included in Code section 61 which attempts to define the components of "income" (Figure 8, page 33). The point is, though your employer may have evidence that you received "wages", he has no knowledge or evidence (unless you tell him) as to whether or not you have any "income". And the law imposes no obligation on employers to determine whether their employees have "income". The government could not impose such a burden on employers because it would amount to the government forcing employers to be detectives for them. In addition, the "income" tax imposed under section 3101 cannot be legally collected until it has been lawfully assessed by the government in accordance with section 6201 of the Internal Revenue Code as shown in Figure 3.

Government Required to Assess and Bill "Social Security" Taxes

Note that Code section 6201 requires that the Secretary of the Treasury make an assessment "of all taxes ... imposed by this title". Since section 3101 clearly imposes an "income" tax, then such taxes are required to be assessed in accordance with Section 6201. In addition, Section 6203 (Figure 4) states that the assessment shall be made by recording the "liability" of the taxpayer "in the office of the Secretary"; and that "upon request of the taxpayer the Secretary shall furnish the taxpayer with a copy of the record of the assessment". In addition, Section 6303 (Figure 5) states that

2 For a more complete analysis, see chapter 3.

FIGURE 3

Sec. 6201. Assessment authority.

(a) Authority of Secretary.

The Secretary is authorized and required to make the inquiries, determinations, and assessments of all taxes (including interest, additional amounts, additions to the tax, and assessable penalties) imposed by this title, or accruing under any former internal revenue law, which have not been duly paid by stamp at the time and in the manner provided by law. Such authority shall extend to and include the following:

(1) Taxes shown on return. The Secretary shall assess all taxes determined by the taxpayer or by the Secretary as to which returns or lists are made under this title.

FIGURE 4

Sec. 6203. Method of assessment.

The assessment shall be made by recording the liability of the taxpayer in the office of the Secretary in accordance with rules or regulations prescribed by the Secretary. Upon request of the taxpayer, the Secretary shall furnish the taxpayer a copy of the record of the assessment.

FIGURE 5

Sec. 6303. Notice and demand for tax.

(a) General rule.

Where it is not otherwise provided by this title, the Secretary shall, as soon as practicable, and within 60 days, after the making of an assessment of a tax pursuant to section 6203, give notice to each person liable for the unpaid tax, stating the amount and demanding payment thereof. Such notice shall be left at the dwelling or usual place of business of such person, or shall be sent by mail to such person's last known address.

after making the assessment the Secretary shall "... give notice to each person liable for the unpaid tax, stating the amount and demanding payment thereof." I, therefore, suggest that you send the letter shown in Figure 6 to the Secretary of the Treasury to determine whether Section 3101 "income" taxes have been properly assessed against you, since without such an assessment you obviously have no "liability" for such taxes!

Can Americans Have Two Types Of "Income"?

What "income" is actually subject to tax under Section 3101 anyway? Can employees have two different kinds of "income"? Obviously the "income" that Americans pay taxes on using a form 1040 is entirely different from the "income" that has served as a basis for the taxes that have been forceably extracted from paychecks pursuant to Section 3101.

When determining 1040 "income", employees are allowed numerous deductions and exemptions and may ultimately arrive at a taxable "income" substantially lower than their wages. Can employees legally have

FIGURE 6

Mr. Donald T. Regan, Secretary

Department of the Treasury

Main Treasury Building

15th Street & Pennsylvania Avenue, N. W.

Washington, D.C. 20220

Dear Mr. Secretary:

Section 6201 of the IRS Code states that you are "required to make the ... assessments of all taxes ... imposed by this title". Section 6203 further states that the assessment shall be made by "recording the liability of the taxpayer in the office of the Secretary" and "upon request of the taxpayer, the Secretary shall furnish the taxpayer with the record of the assessment".

This is to advise you that I would like to be furnished a copy of the record of my tax assessment (pursuant to Sections 6201 and 6203) for any "income" taxes for which I may be liable for under Sections 3101(a) and (b) of the Internal Revenue Code. Please furnish me with my current 1984 assessment and a copy of the assessment for the years 1983, 1982, 1981, 1980, etc. I also note that Section 6303 of the IRS Code states that the Secretary shall "within 60 days after the making of an assessment pursuant to Section 6203, give notice to each person liable for the unpaid tax, stating the amount and demanding payment thereof". This is to inform you that I am notifying my employer that until such time as I receive from you a copy of my record of assessment for the current year, and proof that I have been "made liable" for Section 3101 "income" taxes pursuant to Sections 6201, 6203 and 6303, he is to immediately stop the withholding of all such

"income" taxes from my wages.

Very truly yours,

Ima Freeman

two different kinds of taxable "income"? One being taxable one way under section 3101 and another kind being taxable another way on a form 1040?3 Does the 16th Amendment provide for two different kinds of "income" that are taxable pursuant to that Amendment?

Internal Revenue Code Does Not Define "Income"

Figure 7 is an excerpt from the case of U.S. vs. Bollard in which the Appellate court clearly recognized that"... the general term 'income' is not defined in the Internal Revenue Code." Well, if the general term "income" is not defined in the Internal Revenue Code, how can anyone be sure that they have any "income" that is taxable? You will notice that the court inBallard states that Section 61 of the Code defines "gross income". I have reproduced Code Section 61 (Figure 8) and you will see that the Court is wrong on this point — Code Section 61 does not define "gross income" at all. Code Section 61 attempts to define "gross income" but uses the word "income" in the definition and (as any eighth grader should know) a word cannot be defined by using the word itself in the definition! In other words, Code Section 61 cannot define "gross income" unless the word "income" is also defined.4 But even overlooking this piece of chicanery, Section 61 (Figure 8) admittedly only defines "gross income". In the same manner, Code Section 62 (Figure 9) defines "adjusted gross income",

1 Regular income taxes on a form 1040 are "imposed" in Section 1 of the Internal Revenue Code. It states that "... there is hereby imposed on... taxable income.. .a tax determined in accordance with the following tables..."

4 For a more complete analysis, see Why No One Can Have Taxable Income by Irwin Schiff, to be published in 1984.

FIGURE 7

U.S. v. Ballard, 535 F 2nd 499

535 FEDERAL REPORTER, 2d SERIES

The general term "income" is not defined in the Internal Revenue Code. Section 61 of the Code, 26 U.S.C. § 61, defines "gross income" to mean

all income from whatever source derived, including (but not limited to) the following items:

(1) Compensation for services, including fees, commissions, and similar items;

(2) Gross income derived from business; • •*•••

(5) Rents [.]

while Code Section 63 (Figure 10) allegedly defines "taxable income".

For the reason already stated, neither Code Section 62 nor 63 actually defines "adjusted" or "taxable" income either. But, admittedly, no section of the Code even attempts to define the naked word "income" and it is naked "income" that is allegedly taxed in Code Sec-

FIGURE 8

Sec. 61. Gross Income defined.

(a) General definition.

Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items:

(1) Compensation for services, including fees, commissions, and similar items;

(2) Gross income derived from business;

(3) Gains derived from dealings in property;

(4) Interest;

(5) Rents;

(6) Royalties;

(7) Dividends;

(8) Alimony and separate maintenance payments;

(9) Annuities;

(10) Income from life insurance and endowment contracts;

(11) Pensions;

(12) Income from discharge of indebtedness;

(13) Distributive share of partnership gross income;

(14) Income in respect of a decedent; and

(15) Income from an interest in an estate or trust.

* Note that Section (a) does not include either "wages" or "salaries" as a component of "Gross Income." This omission was not accidental. The government, however, has suceeded in tricking the public into believing that "wages" and "salaries" are "similar items" to "compensation for services", "fees", and "commissions." They are not. A corporation, for example, can receive "compensation for services" as well as "fees" and "commissions," but it cannot receive "wages" or a salary. So wages and salaries are not similar to the items listed in (a) (1) and thus they can not be legally included in "gross income" or any other kind of "income".

FIGURE 9

Sec. 63. Taxable income defined.

(a) Corporations.

For purposes of this subtitle, in the case of a corporation, the term "taxable income" means gross income minus the deductions allowed by this chapter.

(b) Individuals.

For purposes of this subtitle, in the case of an individual, the term "taxable income" means adjusted gross income—

(1) reduced by the sum of—

(A) the excess itemized deductions,

(B) the deductions for personal exemptions provided by section 151, and

(C) the direct charitable deduction, and

(2) increased (in the case of an individual for whom an unused zero bracket amount computation is provided by subsection (e)) by the unused zero bracket amount (if any).

FIGURE 10

Sec. 62, Adjusted gross income defined.

For purposes of this subtitle, the term "adjusted gross ^income" means, in the case of an individual, gross income minus the following deductions:

tion 3101!6 But, if "income" is nowhere defined in the Internal Revenue Code, how can "income" be logically or legally taxed? Can a law tax something that the law does not define? Remember, "income" as such, does not exist. It is an abstract term. Try to take a picture of "income". Since it does not exist in concrete form (as do other taxable commodities such as cigars, cigarettes, beer, wine, gasoline, etc.), it must be clearly defined or it cannot be taxedl Since nowhere in the Code is "income" defined, "income" as used in Section 6103 obviously cannot be taxed on any basis; or as the courts would say:

"Nothing is taxable unless clearly within a taxing statute." (BENTE vs BUGBEE 103 NJL 608)

"Any doubt as to the persons or property intended to be included in a tax statute will be resolved in favor of the taxpayer." (MILLER vs ILLINOIS CJt. CO. 146 Miss 422)

Pursuing this argument further (which amounts to beating a dead horse), "income" as used in Section 3101 cannot logically be different from "income" as defined in Section 63; and taxes on such "income" cannot be deducted automatically from wages without taking into consideration all the deductions and allowances provided by Section 63. If it is automatically deducted, this makes the tax a direct tax on "wages" instead of a tax on "income". Remember, the income tax "imposed" in section 3101 is merely collected as a percentage of wages and is not a tax on wages but a tax on "income".

* You will ultimately discover that no one can have "income" that is taxable either as a "Social Security" tax or as a regular "income" tax. But for now I merely want to demonstrate that no one can have "income" that is taxable under Section 3101 apart from any other consideration and overlooking entirely that "income" itself cannot be the subject of an enforced tax on any basisl

SUMMARIZING THE POINTS IN CHAPTER 2

1. Social Security taxes withheld from employee wages are "income" taxes and not taxes on wages.

2. Since the Internal Revenue Code does not define "income", no one can have "income" that can be subject to section 3101 "income" taxes.

3. No employer can know whether an employee has "income" subject to tax under Section 3101, nor is any employer authorized or required to make such a determination.

4. In any case, Section 6201 of the Internal Revenue Code requires that the Secretary of the Treasury assess Section 3101 "income" taxes.

5. Section 6203 further requires that the Secretary of the Treasury record an employee's Section 3101 "income" tax liability and furnish the employee a copy of that record of assessment if so requested by the employee; and

6. Code Section 6303 requires the government to send a tax bill to each employee for any Section 3101 "income" taxes for which he may be "liable". Until employees receive such a bill they can have no Section 3101 "income" tax liability!

7. It is obviously unconstitutional for the government to impose two "income" taxes on some Americans while millions of government employees and other citizens are subject to just one.

8. There is nothing in the Internal Revenue Code that requires taxes collected as "Social Security" taxes to be earmarked in any way for supposed "Social Security" purposes.

3

How To Stop

Employers From

Withholding "Social

Security' Taxes

To stop your employer from deducting an undefined and unassessed "income" tax from your wages, simply give him the affidavit shown in Figure 11. When you give your employer a sworn affidavit stating that you have no "income" that is taxable under Section 3101, he has no choice but to stop deducting such "income" taxes from your wages.

Employers are only authorized (under Section 3101) to deduct "income" taxes from employee wages. If an employee certifies that he has no "income" the employer has no legal basis for deducting "Social Security" taxes! Employers who, nevertherless, continue deducting these taxes (despite having no proof or a court order to the contrary) are liable to the employee for such arbitrary, unauthorized and unwarranted deductions.

Employers Subject to Lawsuits

If your employer does not immediately stop withholding Section 3101 "income" taxes from your wages

FIGURE 11

AFFIDAVIT

1. I,______________, swear under the penalty of perjury that I have no income that is taxable under 26 U.S.C. 3101.

2. I have never been made liable for any such tax pursuant to 26 U.S.C. 6201.

3. I have never received a copy of any assessment for any such tax, pursuant to 26 U.S.C. 6203.

4. I received no notice of any liability for any such tax, pursuant to 26 U.S.C. 6303.

5. Therefore, you have no legal basis for withholding any "income" taxes (allegedly imposed by 26 U.S.C. 3101) from my wages.

6. I understand that you will rely upon this affidavit in making your determination not to withhold from my wages any taxes imposed pursuant to 26 U.S.C. 3101.

Signature

Date

Notary

My Commission Expires

Attached Exhibits___________________________

* Note: See Appendix C for letter that accompanies this affidavit.

(after you send him your affidavit), you should immediately notify him that you are going to sue him1 for any portion of your wages that he has illegally withheld (or continues to withhold) and sends to the government. Remember, he would be sending the government a portion of your wages for a tax which, by law, you could not possibly owe or be liable for.

The government, however, anticipated that some employees might see through their illegal scam, and would threaten employers with such lawsuits, so they tried to cover this contingency by including Section 3102(b) (see Figure 12) in the Code.

FIGURE 12

Sec. 3102. Deduction of tax from wages.

(b) Indemnification of employer.

Every employer required so to deduct the tax shall be liable for the payment of such tax, and shall be indemnified against the claims and demands of any person for the amount of any such payment made by such employer.

It is a very interesting section of "law", which states that employers "... shall be indemnified against the claims and demands of any person for the amount of any such payment made by such employer." When employers are notified of impending lawsuits they should send the letter shown in Figure 13 to the government. If the government does not respond to this letter by

1 See Appendix C for sample lawsuit.

agreeing to defend and indemnify the employer, then the employer is obviously free to immediately stop withholding Section 3101 "income taxes. Can the government force employers to expose themselves to such lawsuits (by forcing them to withhold money from employee paychecks) without any assurance that they will be defended and indemnified?

Section 3102 — Legal Fiction

Actually, Section 3102(b) is based on fraud (designed to give employers a false sense of security) since it only promises to indemnify employers "required" to deduct Section 3101 "income" taxes. Since no employer is "required" to deduct such taxes, this section cannot apply to any employer! Section 3102(a) (Figure 14) is the Code section dealing with the deduction of such taxes and makes this abundantly clear.

You will note that nowhere in Section 3102(a) does it state that any employer is "required" to deduct Section 3101 "income" taxes. The section merely states that such taxes "... shall be collected...". The Federal government relies on the public confusing "shall" with "required". In these tax statutes, however, the word "shall" actually means "may" and, the word "may" can be used in place of "shall", making the above statement read that employers "may collect" such taxes2.

In any case, the word "shall" appears in this Section only once while the word "may" appears four times

2 For example, the Supreme Court held in Cairo Fulton RE vs. Hecht 95 U.S. 170 that"... as against the government the word shall when used in statutes is to be construed as "may" unless a contrary intention is manifested." For a more detailed explanation of this, see pages 34-37 of How Anyone Can Stop Paying Income Taxes by Irwin Schiff (Hamden, CT: Freedom Books, 1982).

FIGURE 13

Mr. Donald T. Regan

Secretary of the Treasury

Main Treasury Building

15th Street & Pennsylvania Avenue, N.W.

Washington, B.C. 20220

Dear Mr. Secretary:

I have been threatened with a lawsuit by my employee

if I remove any "income" taxes from his/her wages as imposed by 26 U.S.C. 3101.

Attached is his/her affidavit swearing that he/she has no income subject to such tax and further that he/she has never been notified by the government that such a tax was ever assessed or recorded. He/she also swears that he/she has never received any notice of "liability" for such a tax pursuant to 26 U.S.C., Sections 6201, 6203 and 6303.

Not wishing to expose myself to any liability in this matter, I will no longer withhold such taxes from

__________________'s wages until you notify me in

writing that the government will pay any and all costs of litigation and will indemnify me against all claims and losses I might incur (pursuant to 26 U.S.C. 3102[b] should I disregard his/her sworn statement.

Very truly yours,

Fred Hardnose President

FIGURE 14

Sec. 3102. Deduction of tax from wages.

(a) Requirement.

The tax imposed by section 3101 shall be collected by the employer of the taxpayer, by deducting the amount of the tax from the wages as and when paid. An employer who in any calendar quarter pays to an employee cash remuneration to which paragraph (7)(B) of section 3121 (a) is applicable may deduct an amount equivalent to such tax from any such payment of remuneration, even though at the time of payment the total amount of such remuneration paid to the employee by the employer in the calendar quarter is less than $50; and an employer who in any calendar year pays to an employee cash remuneration to which paragraph (7)(C) or (10) of section 3121(a) is applicable may deduct an amount equivalent to such tax from any such payments of remuneration, even though at the time of payment the total amount of such remuneration paid to the employee by the employer in the calendar year is less than $100; and an employer who in any calendar year pays to an employee cash remuneration to which paragraph (8)(B) of section 3121(a) is applicable may deduct an amount equivalent to such tax from any such payment of remuneration, even though at the time of payment the total amount of such remuneration paid to the employee by the employer in the calendar year is less than $150 and the employee has not performed agricultural labor for the employer on 20 days or more in the calendar year for cash remuneration computed on a time basis; and an employer who is furnished by an employee a written statement of tips (received in a calendar month) pursuant to section 6053(a) to which paragraph (12)(B) of section 3121(a) is applicable may deduct an amount equivalent to such tax with respect to such tips from any wages of the employee (exclusive of tips) under his control, even though at the time such statement is furnished the total amount of the tips included in statements furnished to the employer as having been received by the employee in such calendar month in the course of his employment by such employer is less than $20.

and the word "required" does not appear at all! This is no accident. Employers cannot (constitutionally) be forced to be unpaid tax collectors for the government. Such a requirement would render the law unconstitutional since it would violate the 13th Amendment of the U.S. Constitution (which outlaws involuntary servitude). In addition, the government certainly could not compound the illegality by forcing such unpaid tax collectors to further expose themselves to employee lawsuits! Thus, Section 3102(b) is a legal fiction because the government is only authorized to indemnify "employers required to deduct". Since Section 3102 does not impose such a requirement or obligation on any employer, the government is actually barred by law from indemnifying any employer sued by an employee for illegally withholding Section 3101 "income" taxes. And, further, since employers cannot be forced to expose themselves to lawsuits for which they cannot receive indemnification, they should immediately cease withholding such taxes. Of course, any employer can stop deducting anyway, since (as you can see) the law does not impose a withholding requirement! Section 3102(b) does, however, attempt to further trick employers into believing that they can be "liable" for taxes not withheld. But note such a "liability" only extends to employers "required" to deduct and since no employer is "required" to deduct, no employer can be "liable" for the taxes not deducted!

SUMMARIZING THE POINTS COVERED IN CHAPTER 3

1. There is no law that "requires" employers to withhold Section 3101 "income" taxes from employee wages.

2. Supplying a sworn statement to one's employer (certifying that one has no "income" that is taxable under Section 3101) furnishes a legal bar from having such taxes taken from one's pay.

3. Employers withholding Section 3101 "income" taxes from the wages of an employee (after being notified that said employee has no "income" tax liability under Section 3101) can be liable to such employee for any wages illegally withheld and sent to the government.

4. The law bars the government from indemnifying those employers who are sued by their employees for illegally withholding 3101 "income" taxes from their wages.

4

Employers and

Self-Employ eds -

How They, Too,

Can Drop Out

As explained (see page 221, Appendix A), it is the employees who actually pay both portions of "Social Security" taxes. With that in mind let's examine that portion of the tax theoretically paid by the employer per Code Section 3111(a) and (b) (Figure 15). Note again the misleading captions, but also note these important differences:

1. First, the tax on the employer is specifically identified as being an "excise" tax. This clearly establishes that the tax on employees is an un-apportioned, direct tax and, therefore, automatically unconstitutional.1

2. Both Section 3101(a) and (b) clearly show that the taxes they impose are taxes on wages. Note neither section even mentions "income".

This, of course, confirms the fact that Section 3101 taxes are "income" taxes (illegally levied as a direct

1 See Why No One Can Have Taxable Income by Irwin Schiff.

Subchapter B.—Tti OB Employers

Sec. 3111. Rate of tax.

(a) Old-age, survivors, and disability insurance.

In addition to other taxes, there is hereby imposed on every employer an excise tax, with respect to having individuals in his employ, equal to the following percentages of the wages (as defined in section 3121(a) and (t)) paid by him with respect to employment (as defined in section 3121(b))—

(1) with respect to wages paid during the calendar years 1974 through 1977, the rate shall be 4.95 percent;

(2) with respect to wages paid during the calendar year 1978, the rate shall be 5.05 percent;

(3) with respect to wages paid during the calendar years 1979 and 1980, the rate shall be 5.08 percent;

(4) with respect to wages paid during the calendar year 1981, the rate shall be 5.35 percent;

(5) with respect to wages paid during the calendar years 1982 through 1984, the rate shall be 5.40 percent;

(6) with respect to wages paid during the calendar years 1985 through 1989, the rate shall be 5.70

percent; and

(7) with respect to wages paid after December 31,

1989, the rate shall be 6.20 percent.

(b) Hospital insurance.

In addition to the tax imposed by the preceding subsection, there is hereby'imposed on every employer an excise tax, with respect to having individuals in his employ, equal to the following percentages of the wages (as defined in section 3121(a) and (t)) paid by him with respect to employment (as defined in section 3121(b))—

(1) with respect to wages paid during the calendar years 1974 through 1977, the rate shall be 0.90 percent;

(2) with respect to wages paid during the calendar year 1978, the rate shall be 1.00 percent;

(3) with respect to wages paid during the calendar years 1979 and 1980, the rate shall be 1.05 percent;

(4) with respect to wages paid during the calendar years 1981 through 1984, the rate shall be 1.30 percent;

(5) with respect to wages paid during the calendar year 1985, the rate shall be 1.35 percent; and

(6) with respect to wages paid after December 31, 1985, the rate shall be 1.45 percent.

FIGURE 15

tax) as compared to Section 3111 which creates a contrived excise tax, levied "with respect to having individuals in (your) employ equal to a percentage of the wages paid".

The tax is a contrived excise because it is not levied on anything — not a product or even a supposed privilege. Excise taxes are levied on things (i.e. on a bottle of wine, on a pack of cigarettes, on a gallon of gas or, as in the case of Federal estate or gift taxes, on the supposed privilege of bequeathing or giving away property). The fact that this tax is being levied "with respect to having individuals in (one's) employ" is proof that the tax is not a legitimate excise since it is not levied on anything, and cannot be an excise tax within the meaning of the U.S. Constitution! Its use here merely signals the government's attempt to jimmy an unauthorized tax into Article 1, Section 8, Paragraph 1 of the Constitution. That the attempt was, indeed, fraudulent was pointed out by the First Circuit Court of Appeals when it found Social Security unconstitutional on this and other grounds (see pages 68-70).

But, in any case, it should be noted that the tax itself was to be determined by wages and not by income. So the employee tax is clearly a tax on income as opposed to the employer's portion which is a tax on nothing, but measured by employee wages.2

Do Employers Have to Pay The Tax?

The employer's "excise" tax is the only tax created by the Social Security Act for which some legitimacy

z Actually, both taxes are unconstitutional "capitation" taxes. One being measured by wages received and the other measured by wages paid out. For an explanation as to why both capitation taxes are illegal, see Irwin Schiffs Why No One Can Have Taxable Income.

might conceivably be claimed. This is because 1) the tax itself does not claim to be a tax on "income"; 2) the law clearly identifies the tax as an excise tax; 3) the Federal government can levy excise taxes without being restricted by the apportionment provisions the Constitution imposes on direct taxes; and 4) the Supreme Court has held (albeit incorrectly) that the tax is a valid excise. Despite these factors, however, there are a number of legal grounds for not paying the tax.

Social Security Act is Admittedly Repugnant To The Constitution

Since it is a fundamental principal of American jurisprudence that "anything repugnant to the Constitution is null and void" (Marbury vs. Madison 1 CR. 137), it can be argued that since the Social Security Act is admittedly unconstitutional (see pages 85-89) all taxes created under it are, therefore, null and void.

Since Employers Are Not Taxed "For The General Welfare of The U.S.", The Tax is Admittedly Illegal

As explained in Chapter 5, the government (in arguing Social Security's constitutionality before the Supreme Court) claimed that Social Security taxes were not designed to pay for Social Security benefits, but were "true taxes (their) purposes being simply to raise revenue," (page 81). The Supreme Court (in its 1938 decision) refused to rule on this question stating that it would "leave the question open". So if the question was left open in 1938, the question certainly has been closed by the government since it repeatedly admits that Social Security taxes, (and the numerous increases in them), are needed to pay for Social Security benefits, not "simply to raise revenue", (see Chapter 8)

Law Does Not "Require" That The Tax be Paid

But the most basic reason that employers do not have to pay this "excise" tax is that there is nothing in the law that establishes a "liability" for the tax or any requirement that it be paid! For example, IRS Code Section 5703(a) (Figure 16) clearly states that "The manufacturer or importer of tobacco products and cigarette papers and tubes shall be liable for the taxes imposed thereon by Section 5701". Section 5701 (Figure

17) is the Code Section that "imposed" the tax on tobacco products. In addition, Code Section 5703(b) (Figure

18) provides that, "The taxes imposed in Section 5701 shall be paid on the basis of a return". The same wording with respect to the creation of a tax "liability" (and a requirement that such taxes "be paid") appears in numerous other code sections with respect to other Federal taxes. For example, Section 4374 (Figure 19) clearly states that the tax imposed by Section 4371 (Figure 20) "shall be paid on a basis of a return". Since no section of the Internal Revenue Code establishes a "liability", or a requirement that the taxes imposed by Section 3111 "shall be paid", such taxes are, obviously, not required to be paid!

FIGURE 16

Code Sec. 5703

Sec. 5703. Liability for tax and method of payment

(a) Liability for tax.

(1) Original liability. The manufacturer or importer of tobacco products and cigarette papers and tubes shall be liable for the taxes imposed thereon by section 5701.

FIGURE 17

Code Sec. 5701

Sec. 5701. Rate of tax.

(a) Cigars

On cigars, manufactured in or imported into the United States, there shall be imposed the following taxes:

(1) Small cigars. On cigars, weighing not more than 3 pounds per thousand, 75 cents per thousand;

(2) Large cigars. On cigars weighing more than 3 pounds per thousand, a tax equal to 8Va percent of the wholesale price, but not more than $20 per thousand.

Cigars not exempt from tax under this chapter which are removed but not intended for sale shall be taxed at the same rate as similar cigars removed for sale.

(b) Cigarettes.

On cigarettes, manufactured in or imported into the United States, there shall be imposed the following taxes:

(1) Small cigarettes. On cigarettes, weighing not more than 3 pounds per thousand, $8 per thousand.

(2) Large cigarettes. On cigarettes, weighing more than 3 pounds per thousand, $16.80 per thousand; except that, if more than 61/2 inches in length, they shall be taxable at the rate prescribed for cigarettes

weighing not more than 3 pounds per thousand, counting each 23A inches, or fraction thereof, of the length of each as one cigarette.

(c) Cigarette papers.

On each book or set of cigarette papers containing more than 25 papers, manufactured in or imported into the United States, there shall be imposed a tax of V4 cent for each 50 papers or fractional part thereof; except that, if cigarette papers measure more than 6Vi inches in length, they shall be taxable at the rate prescribed, counting each 23/4 inches, or fraction thereof, of the length of each as one cigarette paper.

(d) Cigarette tubes.

On cigarette tubes, manufactured in or imported into the United States, there shall be imposed a tax of 1 cent for each 50 tubes or fractional part thereof, except that if cigarette tubes measure more than 61/2 inches in length, they shall be taxable at the rate prescribed, counting each 23/4 inches, or fraction thereof, of the length of each as one cigarette tube.

(e) Imported tobacco products and cigarette papers and

tubes.

The taxes imposed by this section on tobacco products and cigarette papers and tubes imported into the United States shall be in addition to any import duties imposed on such articles, unless such import duties are imposed in lieu of internal revenue tax.

FIGURE 18

Code Sec. 5703

(b) Method of payment of tax. (.1) In general. The taxes imposed by section 5701 shall be determined at the time of removal of the tobacco products and cigarette papers and tubes. Such taxes shall be paid on the basis of return. The Secretary shall, by regulations, prescribe the period or the event for which such, return shall be made and the information to be furnished on such return. Any postponement under this subsection of the payment of taxes determined at the time of removal shall be conditioned upon the filing of such additional bonds, and upon compliance with such requirements, as the Secretary may prescribe for the protection of the revenue. The Secretary may, by regulations, require payment of tax on the basis of a return prior to removal of the tobacco products and cigarette papers and tubes where a person defaults in the postponed payment of tax on the basis of a return under this subsection or regulations prescribed thereunder. All administrative and penalty provisions of this title, insofar as applicable, shall apply to any tax imposed by section 5701.

FIGURE 19

Code Sec. 4374

Sec. 4374. Liability for tax.

The tax imposed by this chapter shall be paid, on the basis of a return, by any person who makes, signs, issues, or sells any of the documents and instruments subject to the tax, or for whose use or benefit the same are made, signed, issued, or sold. The United States or any agency or instrumentality thereof shall not be liable for the tax.

FIGURE 20

CHAPTER 34—POLICIES ISSUED BY FOREIGN INSURERS

Sec.

4371. Imposition of tax.

4372. Definitions.

4373. Exemptions.

4374. Liability for tax.

Sec. 4371. Imposition of tax.

There is hereby imposed, on each policy of insurance, indemnity bond, annuity contract, or policy of reinsurance issued by any foreign insurer or reinsurer, a tax at the following rates:

(1) Casualty insurance and indemnity bonds. 4 cents on each dollar, or fractional part thereof, of the premium paid on the policy of casualty insurance or the indemnity bond, if issued to or for, or in the name of, an insured as defined in section 4372(d);

(2) Life insurance, sickness and accident policies, and annuity contracts. 1 cent on each dollar, or fractional part thereof, of the premium paid on the policy of life, sickness, or accident insurance, or annuity contract, unless the insurer is subject to tax under section 819; and

(3) Reinsurance. 1 cent on each dollar, or fractional part thereof, of the premium paid on the policy of reinsurance covering any of the contracts taxable under paragraph (1) or (2).

"Social Security" Taxes Paid By The Self-Employed

Theoretically, self-employed individuals acquire Social Security coverage by paying "Social Security" taxes in the form of a "self-employment" tax. This was not included in the original Act but was added in 1954. The forced inclusion of self-employed individuals into

Social Security exposes the whole phony "social" theory under which the program was promoted. People intelligent and disciplined enough to run their own business certainly don't need government bureaucrats (who do not have the ability and/or intelligence to do the same thing) to look after them. But, in any case, the so-called "self-employment Social Security tax" is another fraudulent Federal tax that no one is required to pay. Figure 21 is Section 1401 of the Internal Revenue Code which theoretically established such a "Social Security" tax. Note again the deception employed by the headings, since nowhere does the "law" in either Sections (a) or (b) provide for "Old-age, survivors, and disability insurance" or "Hospital insurance". Both sections merely provide for a tax on "self-employment income" and nothing morel In Section (a)(5) the income tax for the period 12/31/81 —1/1/85 is 8.05%; while in section (b)(4) the tax for the period 12/31/80 —1/1/85 is 1.30% bringing the total tax to 9.8% for 1983. (The tax has now been increased to 11.3% for 1984).

What Is "Self-Employment Income"?

Before "self-employment income" can be taxed, the government must tell us what it is. As explained earlier (see pages 31-35), the Code does not define "income" and, as expected, it doesn't define "self-employment income" either (though the Federal government very ingeniously seeks to create the illusion that it is defined). Since "self-employment income" is nowhere defined in the Code, the tax cannot exist and, on this basis alone, no one need pay such a "tax"!

The Government's Ping-Pong "Definition"

Section 1402(b) of the Code (see Figure 22) states that"... the term 'self-employment income' means the net earnings from self-employment, derived by an indi-

FIGURE 21

CHAPTER 2.—TAX ON SELF-EMPLOYMENT INCOME

Sec. ^

1401. Rate of tax.

1402. Definitions.

1403. Miscellaneous provisions.

t/ Sec. 1401. Rate of tax.

(a) Old-age, survivors, and disability insurance.

In addition to other taxes, there shall be imposed for each taxable year, on the self-employment income of every individual, a tax as follows:

(1) in the case of any taxable year beginning before January 1, 1978, the tax shall be equal to 7.0 percent of the amount of the self-employment income for such taxable year;

(2) in the case of any taxable year beginning after December 31, 1977, and before January i, J979, the tax shall be equal to 7.10 percent of the amount of the self-employment income for such taxable year;

(3) in the case of any taxable year beginning after December 31, 1978, and before January 1, 1981, the tax shall be equal to 7.05 percent of the amount of the self-employment income for such taxable year;

(4) in the case of any taxable year beginning after December 31, 1980, and before January 1, 1982, the tax shall be equal to 8.00 percent of the amount of the self-employment income for such taxable year;

(5) in the case of any taxable year beginning after December 31, 1981, and before January 1. 1985. the tax shall be equal to 8.05 percent of the amount of the self-employment income for such taxable year;

(6) in the case of any taxable year beginning after December 31, 1984, and before January 1, 1990, the tax shall be equal to 8.55 percent of the amount of the self-employment income for such taxable year; and

(7) in the case of any taxable year beginning after December 31, 1989, the tax shall be equal to 9.30 percent of the amount of the self-employment income for such taxable year.

FIGURE 21 (continued)

(b) Hospital insurance. *""

In addition to the tax imposed by the preceding subsection, there shall be imposed for each taxable year, on the self-employment income of every individual, a tax as follows:

(1) in the case of any taxable year beginning after December 31, 1973, and before January 1, 1978, the tax shall be equal to 0.90 percent of the amount of the self-employment income for such taxable year;

(2) in the case of any taxable year beginning after December 31, 1977, and before January 1, 1979, the tax shall be equal to 1.00 percent of the amount of the self-employment income for such taxable year,

(3) in the case of any taxable year beginning after December 31, 1978, and before January 1, 1981, the tax shall be equal to l.OS percent of the amount of the self-employment income for such taxable year;

(4) in the case of any taxable year beginning after December 31, 1980, and before January 1, 1985, the tax shall be equal to 1.30 percent of the amount of the self-employment income for such taxable yeari

(5) in the case of any taxable year beginning after December 31, 1984, and before January 1, 1986, the tax shall be equal to 1.35 percent of the amount of the self-employment income for such taxable year; and

(6) in the case of any taxable year beginning after December 31, 1985, the tax shall be equal to 1.45 percent of the amount of the self-employment income for such taxable year.

(c) Relief from taxes in cases covered by certain inter*

national agreements.

During any period in which there is in effect an agreement entered into pursuant to section 233 of the Social Security Act with any foreign country, the self-employment income of an individual shall be exempt from the taxes imposed by this section to the extent that such self-employment income is subject under such agreement to taxes or contributions for similar purposes under the social security system of such foreign country.

FIGURE 22

Code Sec. 1402

(b) Self-employment Income.

The term "self-employment income" means the net earnings from self-employment derived by an individual (other than a nonresident alien individual) during any taxable year; except that such term shall not include—

vidual ... during any taxable year...". So the "self-employment income tax" is, in reality, a "net earnings" tax. In other words, if "self-employment income" means "net earnings from self-employment" (and the tax is levied on "net earnings from self-employment"), then why isn't the tax called a "net earnings" tax instead of an "income" tax? The reason will be clear shortly, but it it apparent that we now have to find out the meaning of "net earnings" in order to know what is taxable as "self-employment income".

Figure 23 is Section 1402(a) of the code which presumably defines "net earnings from self-employment". We should be able to discover the meaning of "net earnings" from this Section; but, alas, we now find here that "net earnings" means "gross income" less allowable deductions — or, in other words, "net earnings" means "net income" and "net income" means "net earnings" and we are right back where we started!

What those rascals did was, in essence, to define a "big dog" as a "little horse" and a "little horse" as a "big dog". But they did it in such a confusing and complicated manner that no one understood what was going on. And who would squeal anyway — the lawyers and accountants who make money from the deception?

FIGURE 23

Code Sec. 1402

Sec. 1402. Definitions.

(a) Net earnings from self-employment.

The term "net earnings from self-employment" means the gross income derived by an individual from any trade or business carried on by such individual, less the deductions allowed by this subtitle which are attributable to such trade or business, plus his distributive share (whether or not distributed) of income or loss described in section 702(a)(8) from any trade or business carried on by a partnership of which he is a member; except that in computing such gross income and deductions and such distributive share of partnership ordinary income or loss—

Proof that the IRS Code is a total fraud (and those who wrote it knew it!) can be deduced from this "ping-pong" definition between "net income" and "net earnings". Why were two definitions required? Why not one? The answer to this question reveals the whole illegal nature of Federal "income" taxes. The government could not constitutionally tax "earnings" since the 16th Amendment authorizes a tax on "income", not "earnings".3 The tax therefore, had to be couched in terms of an "income" tax, (as explained on pages 87-88). But the Internal Revenue Code, as already explained, does not (and cannot) define "income" so the Federal government had to contrive a definition for "self-employment income" (employing the term "earnings" to do it) in the same manner it contrived a definition for

' But only if levied as an excise tax and not as a direct tax as is presently the case. See Why No One Can Have Taxable Income by Irwin SchifF.

"taxable income". So it proceeded to define "income" as "earnings" and then "earnings" as "income" (a distinction without a difference!) and the nation was none the wiser. At least we can admire the Federal Mafia's creativity! (Which is precisely what the Federal establishment really is. For proof see The Schiff Report, issues 1-6.)

"Can Self-Employment Income" Be Different From "Taxable Income"?

Again, as I have already pointed out, the 16th Amendment only provides for a tax on "income" and not a tax on "self-employment" income (if different from "income" itself). So "self-employment income" legally has to mean the same thing as "taxable income" per Section 63 (Figure 10, page 34) or it is unconstitutional on its very face. The government, however, would have the public believe that it can define and tax "income" two different ways — one way under Section 63 and another way under Section 1401 — which it cannot legally do!

Throw Him Into The Street If He Can't Pay His Social Security Tax

An attendee at an "untax seminar" I was conducting in Sioux Falls, South Dakota in 1977 told me the following story. It seems that he was a self-employed carpenter earning approximately $11,000 per year. However, since he had 9 or 10 children, he had enough deductions to eliminate any Federal "income" tax (even using the fictitious basis the IRS uses to calculate such taxes); and, as a result, he had not filed or paid Federal "income" taxes for a number of years. Somehow his case came to the attention of the IRS. He explained all this to them and they agreed that he had no Federal

"income" taxes to pay. They said, however, that his "Social Security taxes" (i.e. self-employment taxes) were unrelated to his personal deductions or exemptions and, based upon his self-employment income over a number of years, he owed about $3,000 in unpaid Social Security taxes to the government.

Well, this individual told the IRS that he simply didn't have $3,000 to give them. As he explained to me, providing for so large a family took all the money he earned and he did not have a nickel left over with which to pay any portion of such a huge tax bill. So what did the IRS do? They put a lien on his house for the $3,000!!

He had come to my seminar extremely distraught and fearful since the IRS was threatening to auction off his house unless he paid the $3,000. He wanted to know if they could really throw him and his 9 children out into the street if he didn't pay up—as this was precisely what they were threatening to do! Apparently a benevolent government (one that installed Social Security as a means of "helping" people in their old age) was willing to take this couple's home away and throw them and their children out into the street in order to accomplish so noble a goal. How absurd can a situation be?

This poor man really didn't know what to do. He didn't have any extra money with which to pay the tax bill and he was petrified at the thought of being put out of his house with such a large family. He told me, "I don't know where else I can go!" I could offer him little legal help, since at that time I hadn't yet learned that all such IRS liens are illegal and that the Code does not provide for such a tax liablity.

I did suggest that he go to the local newspaper and tell them his story. I felt that the situation was so ludicrous that if he could just focus some publicity on the matter the IRS would probably back off. Apparently this approach worked. I was told that the story did appear in a Sioux Falls paper and the IRS did, indeed,

back off. I wonder, though, how many others have had their homes seized and sold because they couldn't pay their "Social Security" taxes?